10 200 unemployment tax break refund status

Property Tax Relief Programs. The deadline for filing your ANCHOR benefit application is December 30 2022.

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

The IRS has just begun May 14 sending out.

. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. We will begin paying ANCHOR.

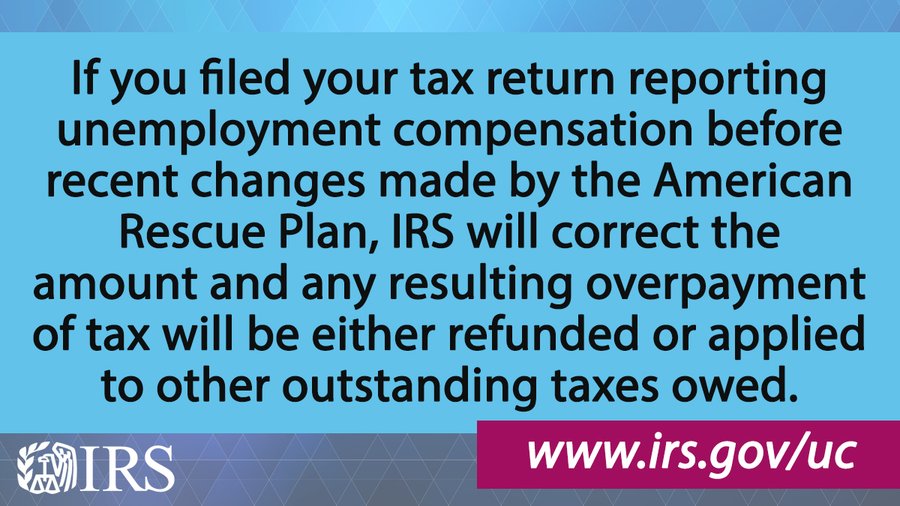

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of. Blake Burman on unemployment fraud. What is the status on the unemployment tax break.

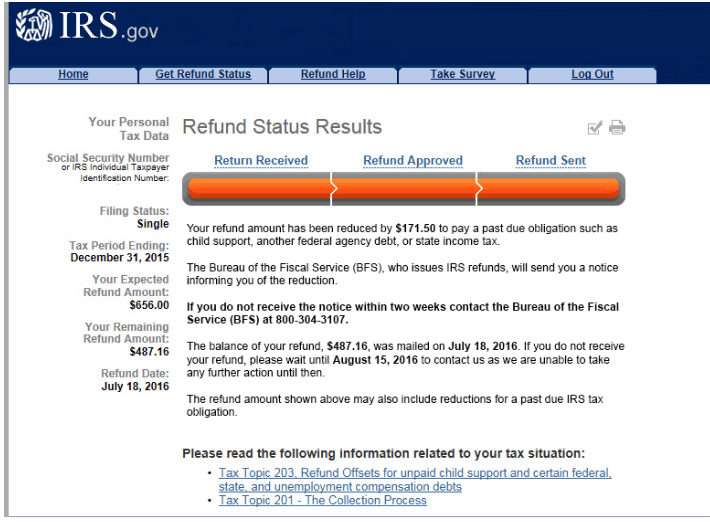

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. When depends on the complexity of your return. It is not your tax refund.

Basically you multiply the 10200 by 2 and then apply the rate. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Enter the original amount you reported in column A the change in column B and the corrected amount in column C.

4058 Minnesota Avenue NE Suite 4000. This is an optional tax refund-related loan from MetaBank NA. Approval and loan amount.

Use the NJ Refund Status link to go to the New Jersey State Income Tax Refund Status Online Tool just have your 2015 Tax folder ready so you can find the required information. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. Those amending their income to remove unemployment.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. This is only applicable only if the two of you made at least 10200 off of unemployment checks. Loans are offered in amounts of 250 500 750 1250 or 3500.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. To reiterate if two spouses. New Jersey State Tax Refund Status Information.

2020 Unemployment Tax Break H R Block

Refund Status Where S My Refund Tax News Information

![]()

Irs Unemployment Tax Refund Tracking Slow Pace Frustrates

Unemployment 10 200 Tax Break Some States Require Amended Returns

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Anyone Have A June 14 2021 Update Does Anyone Know And Estimate Of How Much I Will Get Back From Unemployment Tax Refund R Irs

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Can The Irs Take Or Hold My Refund Yes H R Block

What To Know About Irs Unemployment Refunds

Dor Unemployment Compensation State Taxes

Irs Tax Refunds On 10 200 In Unemployment Benefits When Are They Coming As Usa

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Unemployment Tax Refund Advice Needed R Irs

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com